Investment Objective of the Mutual Fund

The objective of the Mutual Fund is to achieve the highest possible return for unitholders mainly through capital gains, placements of the fund in long-term fixed and/or floating income securities of several mainly Greek issuers and secondarily through income from interest, coupons or dividends, while undertaking the lowest possible investment risk at the same time.

Investment Policy of the Mutual Fund

The Fund’s portfolio is mainly concentrated on Greek government bonds and corporate bonds and selectively on foreign bonds with a satisfactory credit rating (at least BB- by S&P and respectively by Fitch and Moody’s). The mutual fund may invest bonds issued by European Union country members, European emerging markets and emerging markets outside of Europe.

Additionally, the Mutual Fund may use financial derivative products both for the purposes of hedging part of the investment risk included in the portfolio and for effective portfolio management, according to the provisions of article 25 of Law 3283/2004 and the relevant decisions and limitations issued by the Hellenic Capital Market Commission.

The management of the mutual fund’s fixed income securities will be active, with preference to such securities that according to their fundamental and macroeconomic analysis promise the highest possible return with the lowest possible risk. The mutual fund’s risk refers to the fluctuation of prices of bonds related to interest rates, macroeconomic indicators and from credit risk of the bonds’ issuers. The degree of the investment risk is characterized as medium. The Fund refers to investors who are willing to undertake medium risk with a long-term investment horizon.

The benchmark for the performance of the mutual fund, is the performance of the Bloomberg EFFAS Total Return 3-5 Years Greece Index (since 01/01/2011).

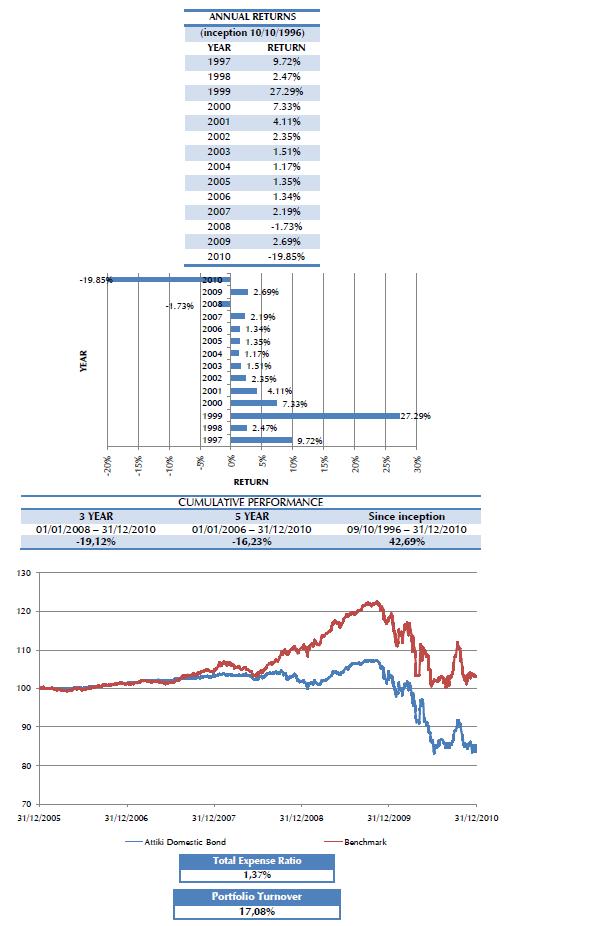

Historic performance and investment risk of the Mutual Fund

The realized performance of Attiki Domestic Bond Fund for the previous years is as follows:

MF Risk Level (min: 1 - max: 5)