Investment Objective of the Mutual Fund

The objective of the Mutual Fund is the appreciation of its value, which may be achieved either through a price increase of securities it is invested in or capital gains, or through income from coupons and dividends.

Investment Policy of the Mutual Fund

The policy of achieving the above objectives is mainly based on the balanced investment of capital mainly between equity and fixed income securities and mainly in European countries and secondarily in Greece and other countries. The mutual fund may invest in special type financial products, which are listed in a recognized by the Hellenic Capital Market Commission organized market, and in non-listed securities following a special approval by the Capital Market Commission. The currency under which the mutual fund’s investments are placed is primarily the Euro.

Additionally, the Mutual Fund may use financial derivative products both for the purposes of hedging part of the investment risk included in the portfolio and for effective portfolio management, according to the provisions of article 25 of Law 3283/2004 and the relevant decisions and limitations issued by the Hellenic Capital Market Commission.

The management of the mutual fund’s fixed income and equity securities will be active, with preference to such securities that according to their fundamental and macroeconomic analysis promise the highest possible return with the lowest possible risk. The mutual fund’s risk refers mainly to the fluctuation of prices of securities it is invested in. Due to its balanced investments, the fund’s risk is characterized as medium to high. The Fund refers to investors who are willing to undertake medium to high risk with a mid to long-term investment horizon. The benchmark for the performance of the mutual fund, is 50% of the performance of the Eurostoxx 50 index and 50% of the Bloomberg EFFAS Total Return 3-5 Years Euroblock Index (since 01/01/2011).

The benchmark for the performance of the mutual fund, is the performance of the Bloomberg EFFAS Total Return 3-5 Years Greece Index (since 01/01/2011).

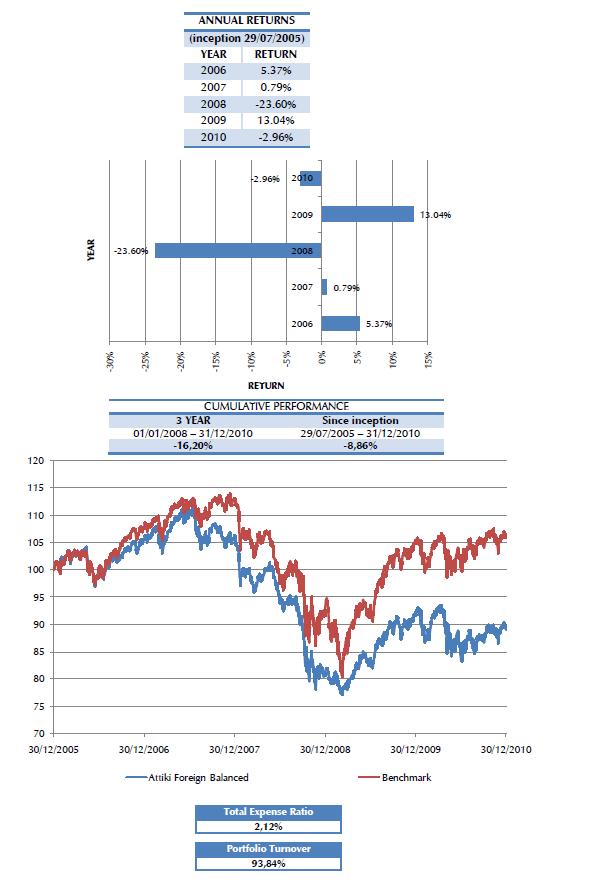

Historic performance and investment risk of the Mutual Fund

The realized performance of Attiki Foreign Balanced Fund for the previous years is as follows:

MF Risk Level (min: 1 - max: 5)